Retirement is a popular topic in the personal finance world. There is a glut of information about when to start saving, what the best strategies are, and how much you’ll need. If you do a simple search for online retirement calculators, you’ll have plenty of options to choose from!

Unfortunately, a lot of the advice can be contradictory or overwhelming. We are told that we need X amount for a 20-year retirement, or that we should contribute X amount to our 401(k). The experts tell us to pay off all of our debt but make sure we have enough liquidity for emergencies. There’s plenty of helpful information available, but how do you make sense of it based on your own unique situation? Since retirement is one of the biggest financial milestones you’ll reach in life, how do you really know if you’re on track? When will you be financially ready?

Comparing The Numbers

With Baby Boomers retiring every day, the Census Bureau predicts that the population aged 65 and over will grow 50% between 2015 and 2030. Because of this, the US Government Accountability Office was tasked with finding out how well prepared American workers are for retirement. They published a comprehensive report in 2015 (1) that we can use to see if your retirement savings are on par with others your age.

Whether you think you’re on top of things or way behind, you may be surprised by what statistics show about retirement savings. Let these numbers serve you as a pat on the back or a kick in the pants.

If You’re Between the Ages of 55 and 64

It may surprise you, but if you have at least $1 saved for retirement, you’re doing better than 41% of those surveyed, and if you have at least $25,000 saved, you’re in the top 59%. Though those numbers may make you feel good about yourself, they don’t guarantee you a comfortable retirement. While you may not know how much you need for retirement, we can be sure it’s more than $25,000.

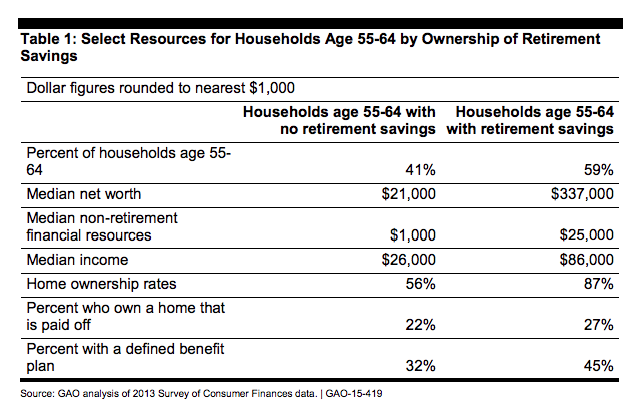

Here is a table from the GAO’s report showing how resources are divided between households with and without retirement savings in this age group.

Clearly, those without retirement savings don’t have a lot to fall back on. Since they lack additional resources, they will be dependent upon pension plans and Social Security to carry them through their retirement years. Of the 59% that have saved, the median nest egg is only about $104,000. With increasing longevity and health care costs, that probably won’t be enough for a worry-free retirement.

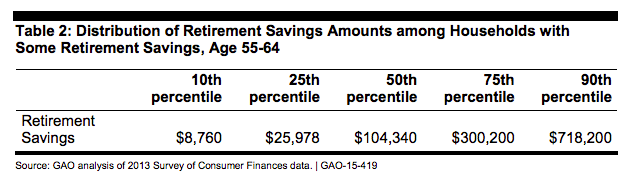

In Table 2, you can see how much savers have actually managed to put away. Where do you fit in?

In this age group, it seems that only the very top savers are ready for retirement. Most of them are still working, though. What about those a decade older? How do you compare to those who have already reached retirement?

If You’re Between the Ages of 65 and 74

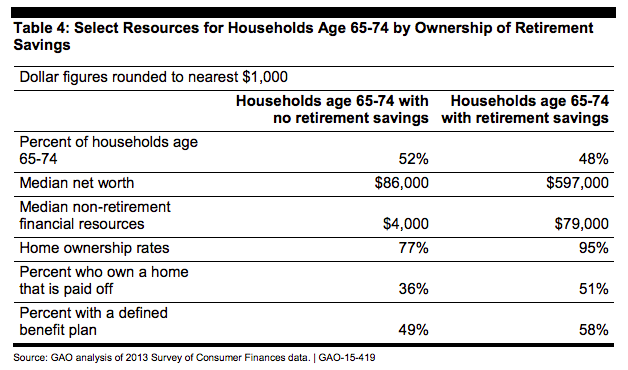

65 is a popular retirement age, though more and more people are extending this date so they can catch up with their retirement savings. Like the previous age group, this bracket doesn’t have much in savings. Here is a chart showing the exact same information as the previous age bracket.

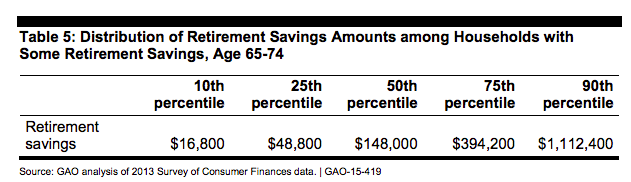

In this age group, people are a little more prepared but with only a slightly larger nest egg. However, the median net worth has increased and homeownership rates are higher. Let’s look at their savings breakdown.

Surprisingly, the median amount saved is not significantly higher than that among households aged 55-64. It only increases from $104,000 to $148,000. The lower percentiles nearly double their savings. Where do you fall? If you’re in the 90th percentile, you’re sitting pretty and probably don’t have anything to worry about in retirement. But what about the lower percentiles?

It doesn’t take a whole lot of savings to look good relative to your peers. But how are your savings relative to your current lifestyle? Will you have enough to live the life you want or do you need to double down and save more?

Your Personal Retirement Goals

No matter how you compare to your peers, you need to figure out how your savings compare to the cost of the retirement you desire. There are plenty of online retirement calculators available, but they are often generic and don’t take into account the various factors that will impact your personal situation.

The only way to have a clear idea of what you’ll need to retire comfortably is to have a financial advisor run a thorough analysis. A professional can utilize technology to show you different possible retirement outcomes and how to prepare for both the good and the bad.

How I Can Help

You may think that if you don’t have much saved you don’t have enough to work with an advisor. The truth is, you can’t afford not to work with an advisor. You need to build wealth and partnering with an experienced professional is the best way to do that.

At Mason & Associates, our goal is to work with you to plan for all stages in your financial life. Don’t keep yourself up at night wondering if you will have enough money to retire. Book your free 30-minute introductory phone consultation today and get started on your Life Planning roadmap.

About Mason & Associates, Inc.

Mason & Associates, Inc. was founded in 1989, specializing in Life Planning for individuals, families and small businesses. Life Planning places a person’s core life values at the heart of the advice process and focuses on the human aspects of financial planning.

As a client, your personal story is key to our planning process. That is why we strive to build a close relationship that will encompass every aspect of your life. Together with our team of professionals, we guide you through the process of identifying what is important to you, your goals, your dreams. We then put into place a financial road map to set you on your way towards achieving your objectives.

Our responsibility does not end there. As you encounter bumps in the road, changes in goals or any other roadblocks, we are there to offer advice and guidance. We are there to celebrate your successes and cope with your challenges. We work alongside your other professionals such as your attorney and your CPA to be sure all of your legal and financial needs are aligned.

_________